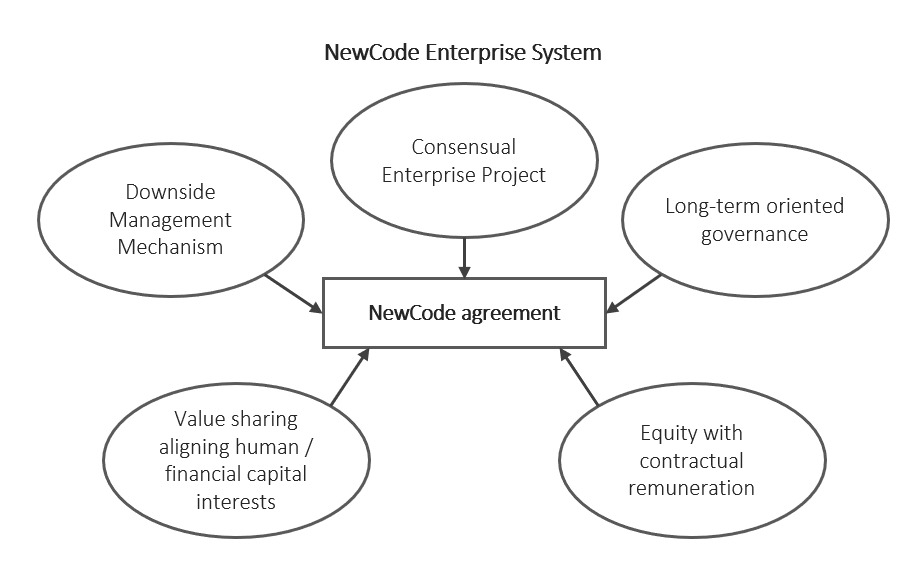

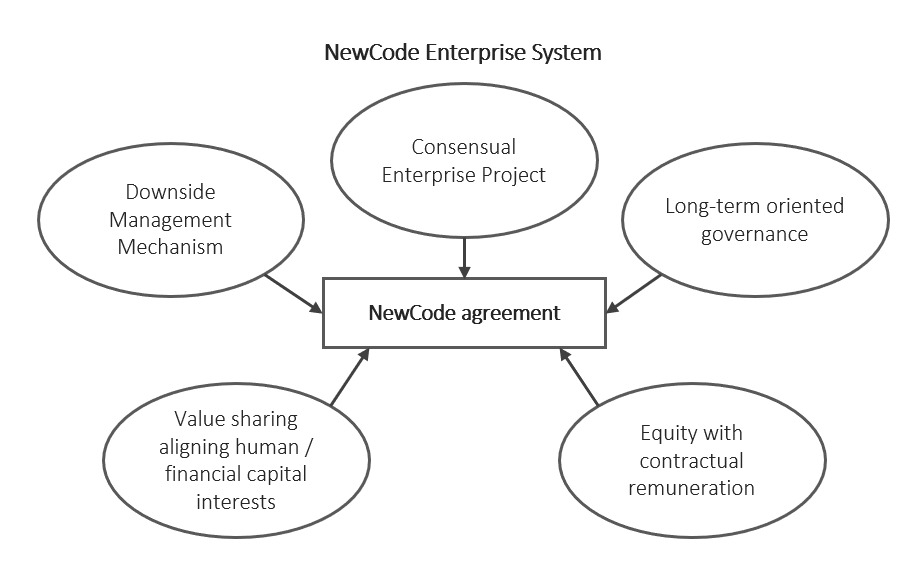

An Enterprise System with 5 modules

NewCode Enterprise system results from a tripartite Accord d'Entreprise between investors, managers and employees

NewCode Enterprise system results from a tripartite Accord d'Entreprise between investors, managers and employees

The strategic project, prepared by the management team, is discussed with the investor and the employee representatives. The adherence of the social body to the project is an essential condition. It forces stakeholders - investors, managers, employees - to develop a shared vision of the future and to put in place a business plan of reference.

The equity investor holds a financial instrument - "NewCode Instrument" - which replaces the ordinary shares, entitles the holder to a fixed interest and a share of the value created. The NewCode instrument presents an intermediate risk-reward profile between equities and bonds.

Value created is shared between human and financial capital in proportions originally planned in the NewCode agreement. Value sharing occurs during the execution of the plan (bonuses, profit-sharing, dividends) and / or during refinancing operations (crystallization and distribution of value).

It is the counterpart to the contracting of the investor's remuneration. The processes of adaptation of the company in case of underperformance are anticipated and documented in the NewCode agreement. This anticipation clarifies in advance the rules of the game and empowers employees to protect the operational performance of the company.

Management representatives, investors, outside directors and employee representatives participate in the governance of the company. Well aware of the realities of the company, they participate, upstream of the decisions, in the debates on the strategic plan, sharing with the other directors their operational knowledge of the company, its markets as well as the performance factors of the organization.

This website is edited by the Académie NewCode, a non for profit organisation, with head offices at 3 boulevard de Sébastopol – 75001 Paris.

The website is hosted by 1&1 SARL France, 7 place de la Gare – 57200 SARREGUEMINES

Contact : contact@academienewcode.com / +33 6 73 33 50 88

All elements published on the website academienewcode.com constitute intellectual work as defined by the Intellectual Property Code.

Any use in the form of representation, modification, reproduction, etc., in whole or in part, without the consent of the authors is forbidden.

We automatically receive and store information from your computer and browser, including your IP address, software and hardware, and the page you request.

Any information we collect from you may be used for:

We do not sell, trade, or transfer your personally identifiable information to third parties. This does not include trusted third parties who help us operate our website or conduct our business, as long as these parties agree to keep this information confidential.

We believe that it is necessary to share information in order to investigate, prevent or take action regarding illegal activities, alleged fraud, situations involving potential threats to the physical security of any person, violations of our terms and conditions. use, or when the law compels us to do so.

Non-private information, however, may be provided to other parties for marketing, advertising, or other uses.

We implement a variety of security measures to safeguard the security of your personal information. We use state-of-the-art encryption to protect sensitive information transmitted online. Computers and servers used to store personally identifiable information are kept in a secure environment.

Yes. Our cookies improve access to our site and identify regular visitors. In addition, our cookies improve the user experience by tracking and targeting their interests. However, this use of cookies is in no way linked to personally identifiable information on our site.

By using our site, you consent to our privacy policy.

Basic NewCode Capital Structure comprises Senior Debt and NewCode Instrument (NCI). NCI comes in lieu of the traditional equity layer, carries a Contractual Fixed Return, is protected by the Downside Management Mechanism, and has a share in the Value Sharing Component.

At inception CS is sized according to the CEP, e.g. provides the funding necessary to the CEP which in turn provides for the Contractual Fixed Return during the CEP Period and satisfactory prospect of refinancing and Value Sharing at maturity.

The regeneration of the Capital Structure allows the funding of the Enterprise capital needs, as well as, in case net capital inflows exceed such needs, value distribution to Human and Financial Capital. Proportions of such distribution are pre-agreed within the NewCode Enterprise System, as well as, for Human Capital, the way such value is split between Governance, Management and Employees.

When the regeneration of the Capital Structure is carried out in an Alert situation (see Value Sharing and Downside Management Tab), net capital inflows are used to fund the adjustment measures provided for in the NES-Downside Management Mechanism.

NewCode Governance is independent from any single stakeholder and is a balanced representation of all stakeholders, in charge of and only of the long term interest of the Enterprise as governance will itself define and update it : maintain and support a NewCode Enterprise System through which the Enterprise has the best chances to successfully employ and expand its Human Capital, and efficiently source Financial Capital to do so.

Governance comprises representatives from NewCode Instrument, management, employees, and as the case maybe strategic partners as well as external expertise.

Governance defines/adjusts strategic perimeter, appoints and replaces management team, creates and maintains consensus on the Consensual Enterprise Project, maintains alignment of interests across the enterprise system, and makes the best of the capital markets to maintain/expand Capital Structure according to the Enterprise needs.

Governance members are compensated according to the Enterprise success, through the CEP and Value Sharing component.

The VS component defines how added value is shared between the enterprise, financial and human capital.

When the enterprise performs at or above the CEP, added value is first distributed as per the CEP, and any excess is allocated to human capital, financial capital and reserves in pre-agreed proportions.

If the Enterprise performs below plan, however without reaching a pre-defined Alert level, Management is in charge of implementing relevant improvement measures.

Should the Enterprise break the Alert level, Governance takes charge for a revision of the CEP, and as the case maybe the implementation of measures provided for in a pre-agreed Downside Management Mechanism.

In certain circumstances, Value Sharing and Downside Management Mechanisms are funded through a regeneration of the Capital Structure, rather than solely from the use of the Enterprise own generated resources. In such a case the associated net capital inflow is used to distribute part of the Enterprise Value created to human and Financial Capital. In a turnaround situation, it is used to fund the turnaround plan. See Capital Structure module.

The basis for any NewCode transformation is the establishment of a Consensual Enterprise Project (CEP), where human and financial Capital agree on the target future of the enterprise and commit themselves accordingly.

The CEP contains all components usually associated with strategic and business planning in terms of perimeter, capex, sales and non personal costs projections. It also includes projections for the compensation of both financial and human capital, e.g. the way added value will be shared between human and financial capital should the Enterprise perform according to the CEP.

The CEP is also a major input for the sizing and design of the Capital Structure, e.g. the Capital Structure has to provide the capital resources needed by the CEP, and conversely CEP metrics have to allow the service of the Capital Structure and its refinancing at maturity.

The CEP provides the base case for the design of the Value Sharing Mechanism, and also for the Downside Management Mechanism which will come into play should the enterprise perform significantly below the base case.

The management team is in charge of drafting the CEP. Governance is in charge of achieving a consensus on the CEP, between management, employee representatives and investors.